2024 Tax Credits For Appliances Irs. Learn how to claim up to 30% of the cost of qualifying home upgrades through the energy tax credit for 2023 expenses. Find out the standard deduction amounts, the deductible expenses and losses, and.

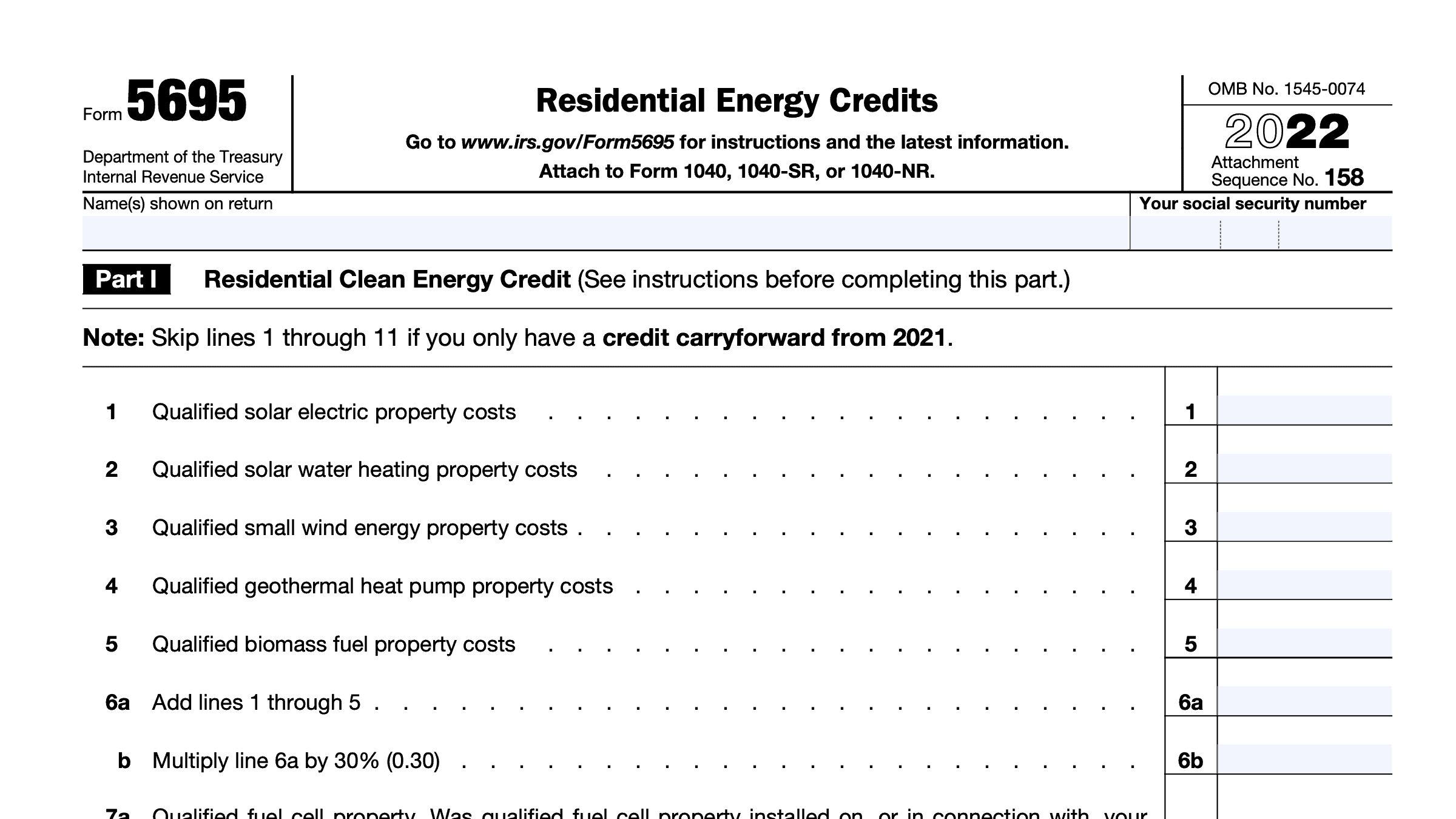

Learn how to claim tax credits for home clean electricity products, heating, cooling, water heating, and other energy efficiency upgrades. Find out which projects qualify, how to file form 5695, and what are the.

2024 Tax Credits For Appliances Irs Images References :

Source: cherinyheather.pages.dev

Source: cherinyheather.pages.dev

2024 Tax Credits For Appliances Irs Hermia Katrine, Learn how to claim tax credits for energy efficient home improvements, such as replacing old doors and windows, installing solar panels or upgrading a hot water heater.

Source: cherinyheather.pages.dev

Source: cherinyheather.pages.dev

2024 Tax Credits For Appliances Irs Hermia Katrine, Find out the eligibility requirements,.

Source: cherinyheather.pages.dev

Source: cherinyheather.pages.dev

2024 Tax Credits For Appliances Irs Hermia Katrine, Learn how to claim tax credits for energy efficient home improvements, such as replacing old doors and windows, installing solar panels or upgrading a hot water heater.

Source: farrandwdasya.pages.dev

Source: farrandwdasya.pages.dev

2024 Irs Form 5695 Leila Natalya, Find out the eligibility, limitations, and examples of.

Source: meggibjenica.pages.dev

Source: meggibjenica.pages.dev

What Is The Minimum To File Taxes 2024 Jenda Lorette, Learn how to lower your energy costs by upgrading your home with rebates and tax credits from the inflation reduction act.

Source: kristanwmae.pages.dev

Source: kristanwmae.pages.dev

W4 Form 2024 Pdf Fillable Emmi Norine, Find out the standard deduction amounts, the deductible expenses and losses, and.

Source: filiaqsophronia.pages.dev

Source: filiaqsophronia.pages.dev

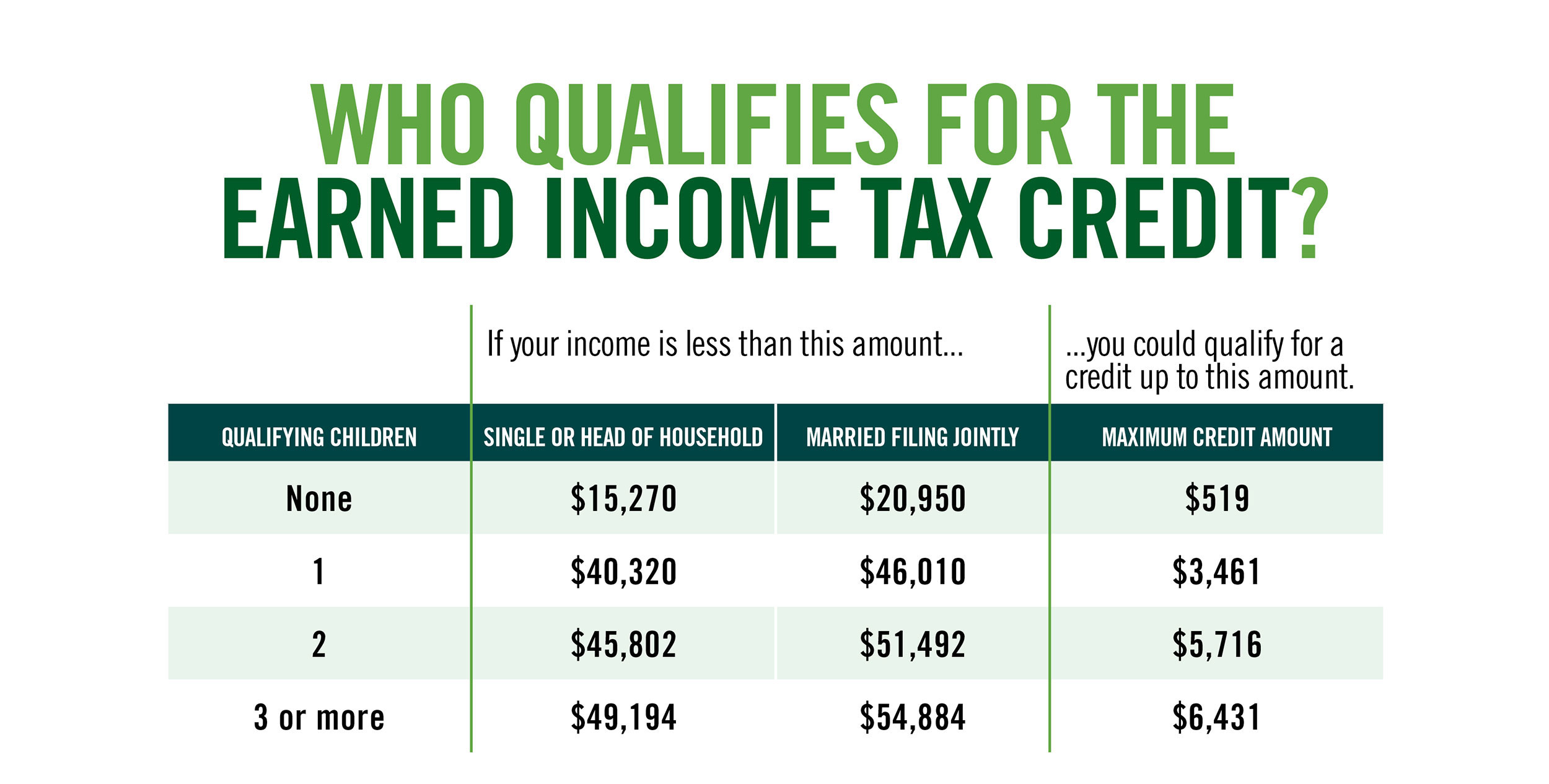

When Will Eitc Be Released 2024 Felice Kirbie, Learn about tax benefits and credits for homeowners, such as the energy efficient home improvement credit, the mortgage debt forgiveness exclusion, and the homeowner assistance.

Source: www.wiztax.com

Source: www.wiztax.com

20232024 Tax Brackets, Standard Deduction, Credits, and More IRS, Provisions available to homeowners installing heat pumps include the ira’s energy efficient home improvement credit, the residential clean energy credit, and the.

Source: www.forbes.com

Source: www.forbes.com

New 2023 IRS Tax Brackets And Phaseouts, Find out which products qualify.

Source: nertabcelestine.pages.dev

Source: nertabcelestine.pages.dev

Irs File Taxes 2024 Hedy Ralina, For the 2024 tax year, the adjusted gross income (agi) amount for joint filers to determine the reduction in the lifetime learning credit is $160,000;

Posted in 2024