Medicare Part D Late Enrollment Penalty 2024. The medicare part d late enrollment penalty is an additional cost that may be added to your medicare part d prescription drug plan premium if you don’t enroll in a part d plan when you are first eligible and go without creditable prescription drug coverage for an extended period. Learn about the different medicare enrollment periods, when you can enroll in a plan, what happens if you enroll late, and more.

In 2023, the penalty would add more than $50 to your. If you didn’t have creditable prescription drug coverage and didn’t enroll in a part d plan during your initial enrollment period in medicare, you will owe a lifetime penalty (except those on medicaid or currently approved for the extra help program).

For Example, If You Went Without Signing Up For Medicare Part A For Two Years, You Would Owe The Extra Penalty Amount For Four Years.

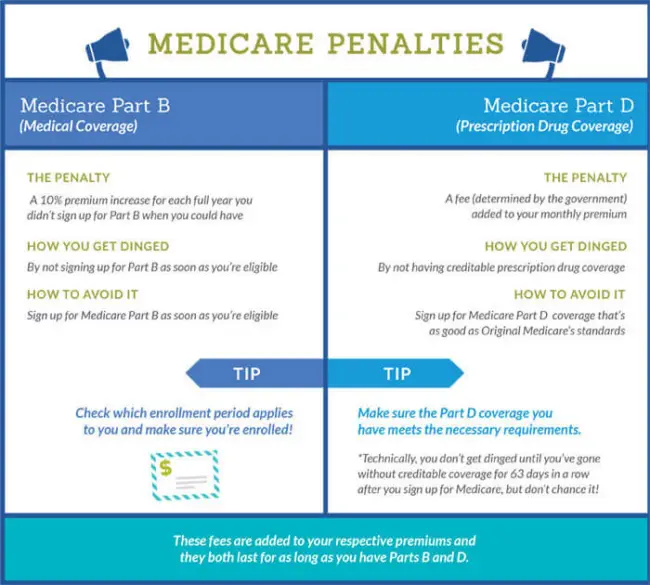

The part d late enrollment penalty only applies if you go without medicare drug coverage or equivalent “creditable” drug coverage for a period of 63 consecutive days at any point after your medicare initial enrollment period ends and decide to join a part d plan later on.

Your Medicare Part D Penalty Would Be 24 Percent Of The National Base Premium, One Percent For Each Of The 24 Months You Waited.

This amount is added to the part d monthly premium.

You’ll Start To Owe A Late Enrollment Penalty If You Go At Least 63 Days Without Sufficient Prescription Drug Coverage After The End Of Your Initial Medicare.

Images References :

Source: www.youtube.com

Source: www.youtube.com

Medicare Part D Late Enrollment Penalties Explained YouTube, The part d late enrollment penalty only applies if you go without medicare drug coverage or equivalent “creditable” drug coverage for a period of 63 consecutive days at any point after your medicare initial enrollment period ends and decide to join a part d plan later on. If you disagree with your penalty, you can request a review (generally within 60 days from the date on the letter).

Source: www.youtube.com

Source: www.youtube.com

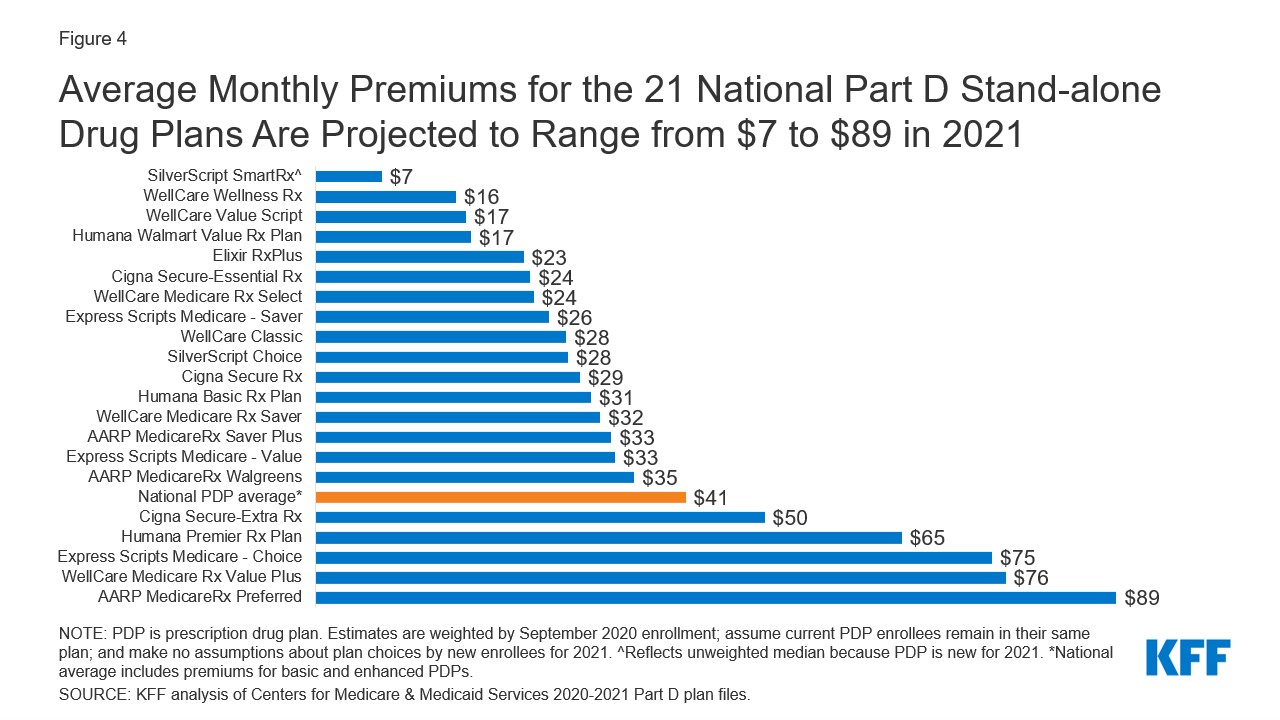

Medicare Part D Late Enrollment Penalty YouTube, From 2024 through 2030, average basic part d. Medicare drug plan (part d) or.

Source: www.youtube.com

Source: www.youtube.com

Part D Late Enrollment Penalty YouTube, You’ll start to owe a late enrollment penalty if you go at least 63 days without sufficient prescription drug coverage after the end of your initial medicare. For example, if you went without signing up for medicare part a for two years, you would owe the extra penalty amount for four years.

Source: blog.medicaresolutions.com

Source: blog.medicaresolutions.com

What Is the Medicare Late Enrollment Penalty?, This amount is added to the part d monthly premium. Medicare initial enrollment period and open enrollment.

Source: www.youtube.com

Source: www.youtube.com

How To Avoid The Medicare Part D Late Enrollment Penalty YouTube, Medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. If you don’t sign up for medicare when you first become eligible, you may face a late enrollment penalty.

Source: www.goodrx.com

Source: www.goodrx.com

How to Avoid the Medicare Part D Late Enrollment Penalty GoodRx, Medicare advantage plan (part c) with drug coverage will send you a letter stating you have to pay a late enrollment penalty. A late enrollment penalty is an amount you must pay to medicare in addition to the regular monthly premium for late enrollment in part b or part d.

Source: www.elitecarehc.com

Source: www.elitecarehc.com

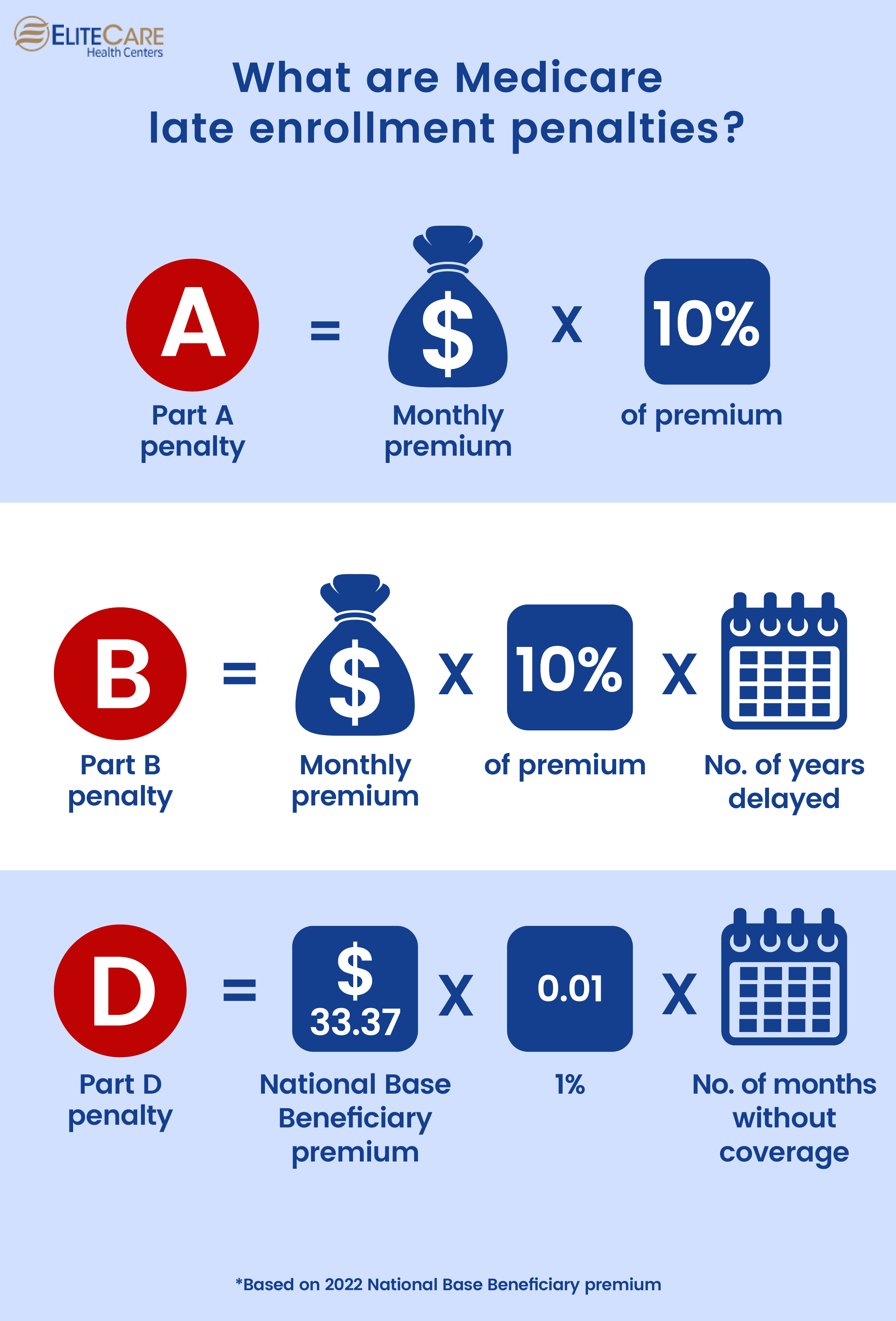

Medicare Late Enrollment Avoid Penalties EliteCare HC, Medicare calculates the penalty by multiplying 1% of the national base beneficiary premium ($34.70 in 2024) times the number of full, uncovered months you didn't have part d or creditable coverage. Medicare part b covers necessary and preventive services for those 65+ or with certain conditions.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

What Is The Penalty For Signing Up For Medicare Late, The part d penalty is determined by taking 1% of the “national base beneficiary premium” times the number of months someone has gone without having part d or creditable drug coverage. There are two main enrollment periods for part d coverage:

Source: legacyhealthinsurance.com

Source: legacyhealthinsurance.com

How To Calculate & Avoid Medicare Late Enrollment Penalties Legacy, Your medicare part d penalty would be 24 percent of the national base premium, one percent for each of the 24 months you waited. The medicare part d late enrollment penalty is a potentially permanent addition to your monthly part d premium, according to the centers for medicare and medicaid services (cms).

Source: www.youtube.com

Source: www.youtube.com

Medicare Part D Late Enrollment Penalty YouTube, If you don’t sign up for medicare when you first become eligible, you may face a late enrollment penalty. The average monthly premium for a medicare part d plan in 2024 is $34.70.

What Is The Part D Late Enrollment Penalty?

The part d late enrollment penalty only applies if you go without medicare drug coverage or equivalent “creditable” drug coverage for a period of 63 consecutive days at any point after your medicare initial enrollment period ends and decide to join a part d plan later on.

A Medicare Late Enrollment Penalty (Lep) Is A Fee You Must Pay If You Did Not Sign Up For Medicare When You Were First Eligible.

Medicare initial enrollment period and open enrollment.